Table of Contents

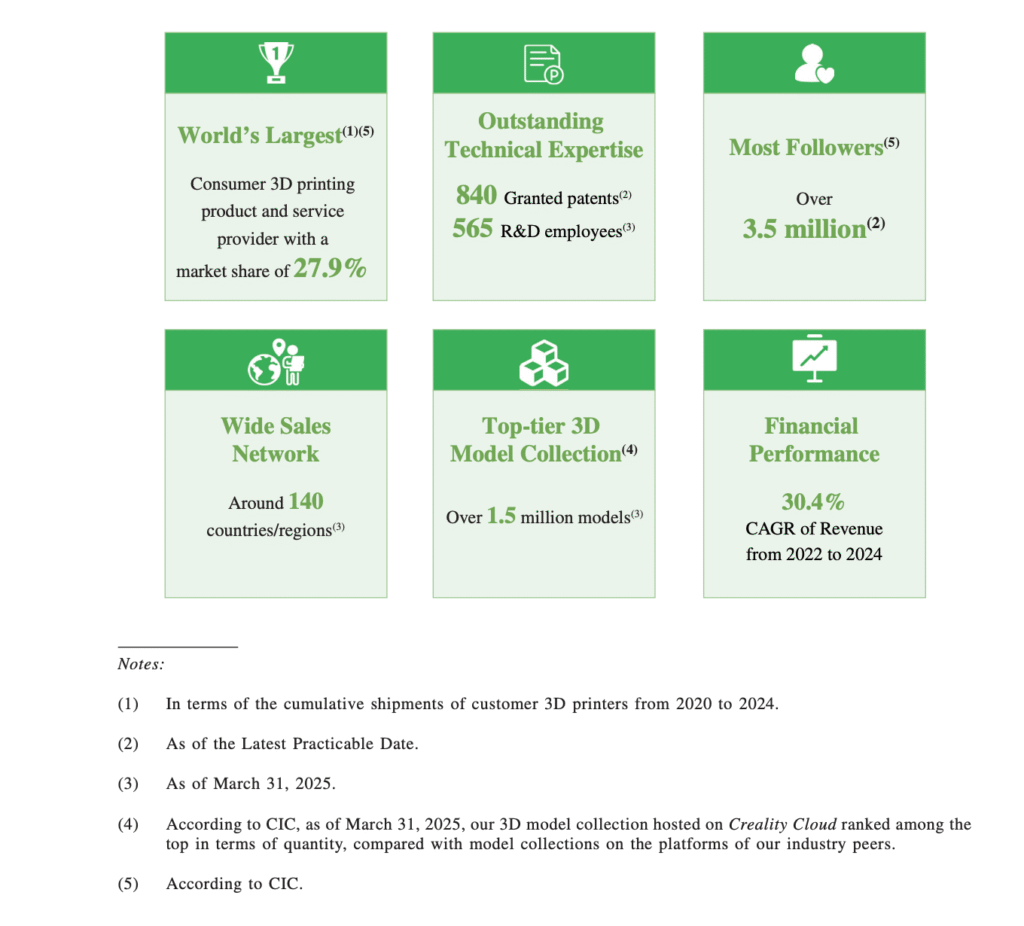

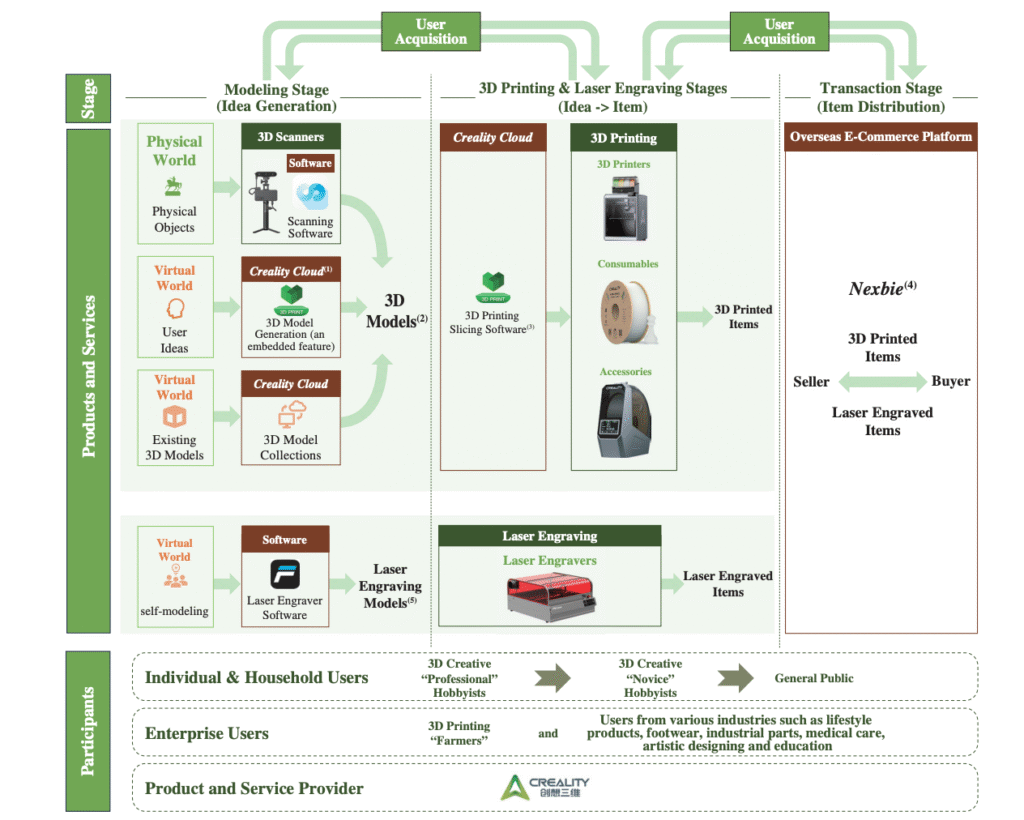

Over the last few years, something quiet but important has happened in consumer 3D printing. The machines got good enough. Print quality improved. Speed improved. Stability improved.

For most users today, the main question is no longer “Can this printer work?”

That problem is mostly solved. What really separates brands now is everything around the printer.

Can users scan real objects easily? Can they buy filament without thinking twice? Can different tools work together as one system?

This is the context in which Creality filed for its IPO.

From my point of view, the timing is not random. It reflects a clear shift in how the company sees its own future.

1. Creality Is Not Just Telling a “Bigger Hardware” Story

If Creality only wanted to show growth, it could talk about units shipped or new printer models or lower prices.

But that is not what the IPO document focuses on. Instead, it keeps pointing to a broader idea: a full 3D creation workflow, not just printers.

To understand this shift, we need to look at the numbers.

Revenue Is Growing — but the Mix Is Changing

Below is the actual revenue breakdown disclosed in the IPO application, shown in RMB million (converted from RMB ’000).

Revenue by Business Line (RMB million)

| Business line | FY2022 | % | FY2023 | % | FY2024 | % | 2025 Q1 | % |

|---|---|---|---|---|---|---|---|---|

| 3D printers | 1,099.5 | 81.7% | 1,403.8 | 74.6% | 1,416.1 | 61.9% | 434.1 | 61.3% |

| Consumables | 40.4 | 3.0% | 136.2 | 7.2% | 261.5 | 11.4% | 84.7 | 12.0% |

| 3D scanners | 53.2 | 4.0% | 41.5 | 2.2% | 207.6 | 9.1% | 86.4 | 12.2% |

| Laser engravers | 12.6 | 0.9% | 111.2 | 5.9% | 163.4 | 7.1% | 44.6 | 6.3% |

| Accessories & others | 140.6 | 10.4% | 188.3 | 10.0% | 236.3 | 10.3% | 56.7 | 8.0% |

| Total | 1,346.4 | 100% | 1,882.9 | 100% | 2,288.3 | 100% | 708.0 | 100% |

Unit note:

- Original IPO tables use RMB ’000

- All figures above are converted to RMB million for clarity

What This Table Tells Me

Printers are still the biggest business. But their share is falling fast.

At the same time:

- Consumables are rising

- Scanners are rising even faster

- Laser engraving is no longer a side project

This does not look like a company adding random products. It looks like a company changing how it grows.

Why This Matters More Than Total Revenue

Selling printers is mostly a one-time deal.

You sell a box. The transaction ends. But consumables work differently. Scanners work differently.

So do lasers. They create:

- Repeat purchases

- Longer customer life

- More chances to sell again

From my view, this is the real IPO story.

Creality is trying to move from: “Sell more machines” to “Serve users across the whole creation process.”

This is why I do not see Creality’s IPO as a simple hardware listing. I would describe it as an attempt to change its growth model.

Not all of this will be easy. Not all of it will succeed. But the direction is already visible in the data.

2. Growth Is Not Just Bigger — It Is Getting Better

Revenue growth alone does not mean much.

For a hardware company, the real question is simple: Is the company earning better money, not just more money? This is where Creality’s IPO data becomes interesting.

Gross Margin Is Moving in the Right Direction

First, let’s look at gross margin.

These numbers come directly from the IPO application. Gross profit is already reported in RMB million.

Revenue, Gross Profit, and Gross Margin

| Period | Revenue (RMB m) | Gross Profit (RMB m) | Gross Margin |

|---|---|---|---|

| FY2022 | 1,346.4 | 387.8 | 28.8% |

| FY2023 | 1,882.9 | 599.5 | 31.8% |

| FY2024 | 2,288.3 | 707.8 | 30.9% |

| 2024 Q1 | 550.2 | 186.9 | 34.0% |

| 2025 Q1 | 708.0 | 249.5 | 35.2% |

Why This Matters

Margins stayed around 30% for several years. Then they moved higher. This tells me a few things.

First, new businesses are not dragging margins down.

Second, direct sales are starting to help.

Third, product mix is improving.

This does not look like growth driven by discounts. It looks controlled.

Higher Costs, but for a Clear Reason

Some readers may notice this: Sales and marketing costs went up.

At first glance, that sounds risky. But context matters. Creality is doing three things at the same time:

- moving from distributors to direct sales

- selling more consumables and scanners

- building its own customer base

All of that costs money upfront. From my view, the key question is not “Are costs rising?”

It is: Are those costs changing the structure of the business? So far, the answer looks like yes.

Customer Concentration Is Falling Fast

This is one of the most important signals in the IPO.

Here is the exact customer concentration data disclosed.

Top Customer Revenue Concentration

| Period | Top 5 Customers (RMB m) | % of Revenue | Largest Customer % |

|---|---|---|---|

| FY2022 | 496.6 | 36.9% | 14.3% |

| FY2023 | 374.4 | 19.9% | 5.7% |

| FY2024 | 351.6 | 15.4% | 5.8% |

| 2025 Q1 | 100.2 | 14.1% | 4.9% |

Why I Pay Attention to This

When a few customers control your revenue, they control your business.

That risk is now much lower. This change lines up perfectly with:

- more online sales

- more direct customers

- less dependence on large distributors

For a hardware company, this is a quiet but powerful upgrade.

My Take on Growth Quality

Revenue is growing. But more importantly:

- margins are improving

- customers are more diversified

- growth comes from structure, not shortcuts

From my perspective, this is what “better growth” looks like.

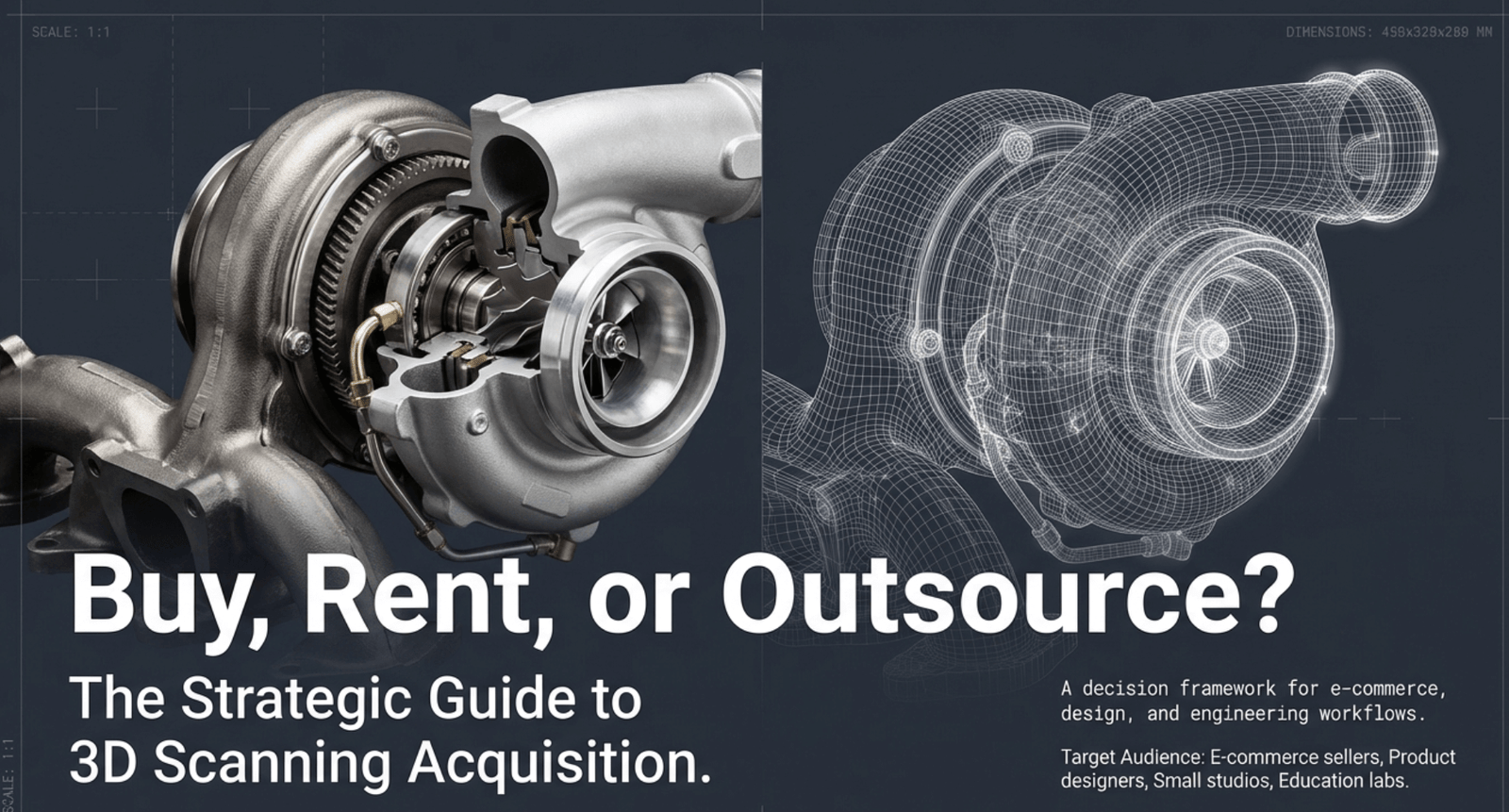

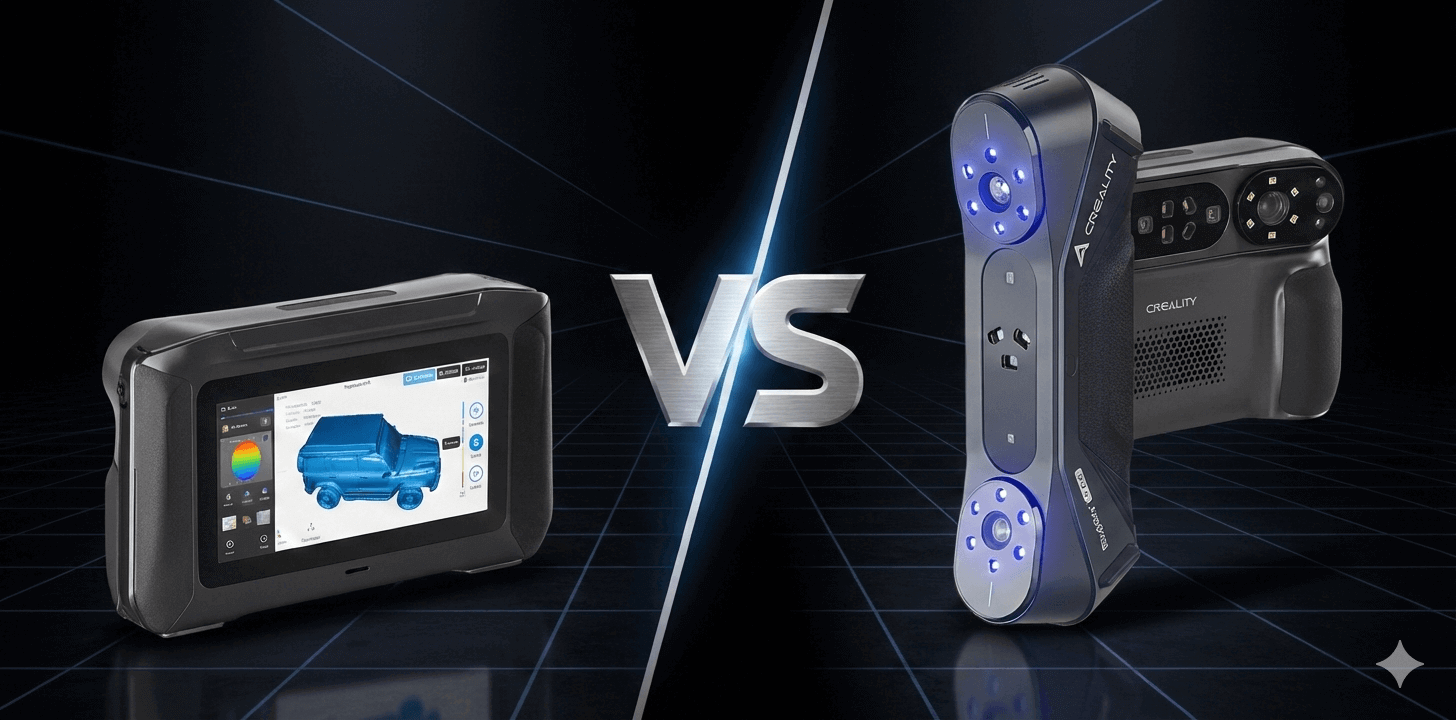

3. Why 3D Scanners Are the Real Second Growth Engine

Among all non-printer businesses, 3D scanners stand out. Not because they sound exciting. But because the data supports them. From my view, this is the most important new business in Creality’s IPO story.

This Is a Concentrated Market, Not a Crowded One

The consumer 3D scanner market is very different from printers. It is not fragmented. It is already concentrated. According to the market data quoted in the IPO document:

- The top 3 companies account for

- 83.5% of global shipments

- 79.9% of global GMV

That tells me one thing very clearly: This market has already picked its winners.

Creality Is Not “One of the Players” — It Is the Leader

Now look at Creality’s position in that market.

Consumer 3D Scanner Market Share (2024)

| Metric | Creality | Market Top 3 |

|---|---|---|

| Shipment share | 37.7% | 83.5% |

| GMV share | 37.6% | 79.9% |

This matters for two reasons.

First, Creality leads both volume and value.

Second, these two numbers are almost the same.

That means growth is not coming from low prices. It comes from real demand.

Scanner Revenue Is Scaling Fast

Now let’s look at Creality’s scanner business itself.

3D Scanner Revenue (RMB million)

| Period | Revenue |

|---|---|

| FY2022 | 53.2 |

| FY2023 | 41.5 |

| FY2024 | 207.6 |

| 2024 Q1 | 15.8 |

| 2025 Q1 | 86.4 |

This jump is not small. It is structural. From FY2023 to FY2024, revenue grew five times.

Unit Sales and Pricing Are Rising Together

Even more important is how this growth happened. The IPO document discloses both units sold and ASP.

3D Scanner Units and ASP

| Period | Units Sold (’000) | ASP (RMB) |

|---|---|---|

| FY2023 | 24.0 | 1,731.7 |

| FY2024 | 72.1 | 2,878.8 |

| 2024 Q1 | 9.1 | 1,739.6 |

| 2025 Q1 | 28.4 | 3,042.7 |

This is the key signal for us. Units went up. Prices also went up. That almost never happens by accident.

It usually means:

- better products

- stronger brand trust

- higher switching costs

Why Scanners Matter More Than Lasers

Scanners sit at the first step of the creation process.

Physical object → digital model → output.

If you control the first step, you gain leverage over the rest.

That includes:

- printing

- laser engraving

- materials

- software

- upgrades

From my perspective, this makes scanners a gateway product. Not a side business.

My Take on Scanners

I don’t see scanners as “extra revenue”. I see them as a control point. They bring users into the ecosystem early. They raise switching costs. They support higher-value follow-on sales.

This is why, in this IPO, scanners matter more than most printer launches.

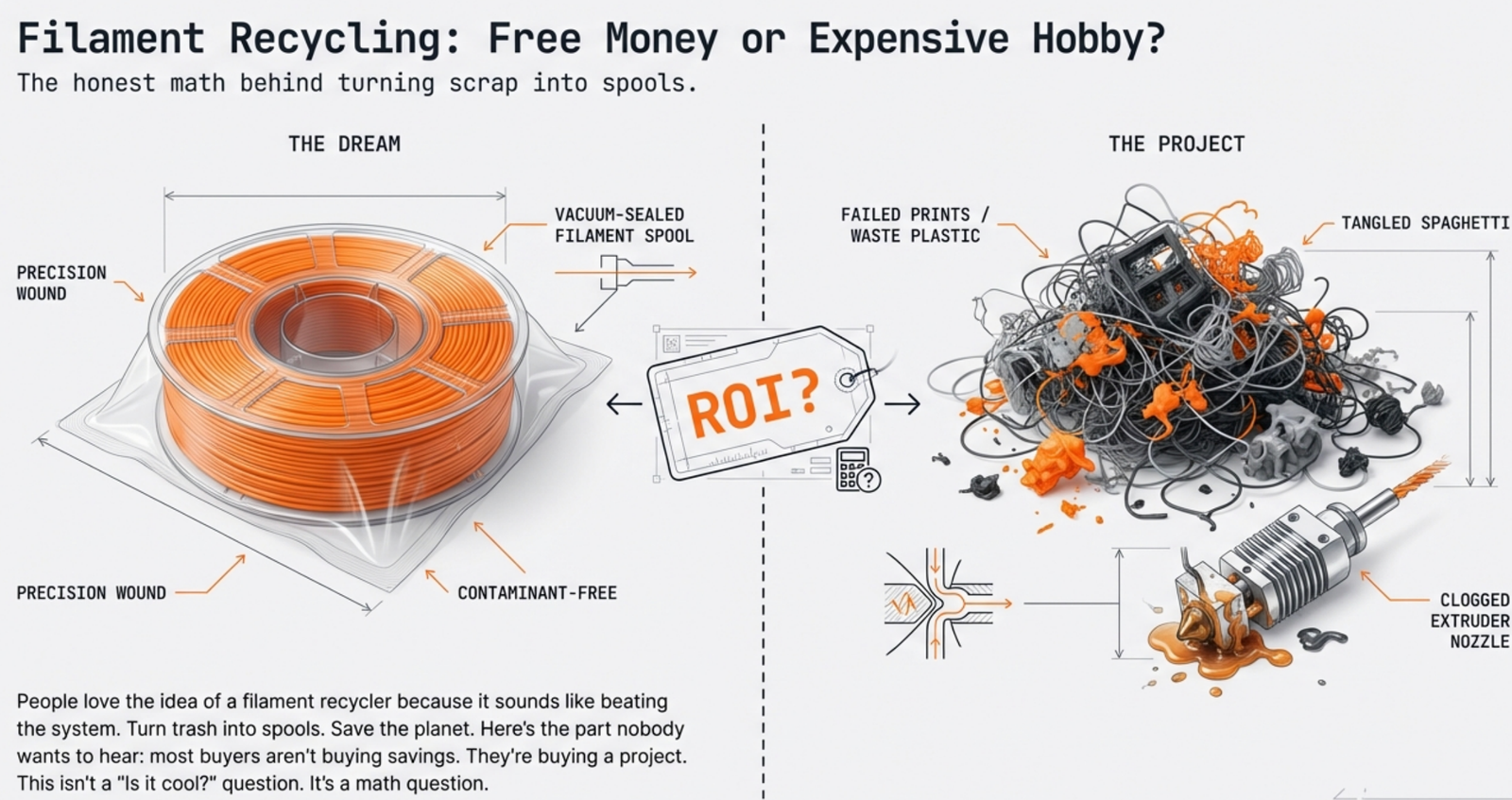

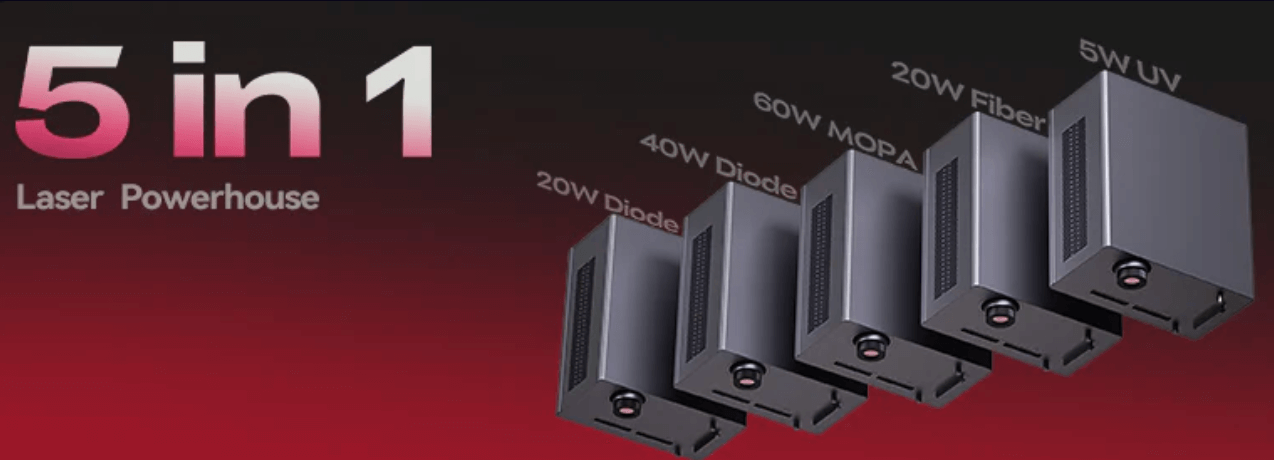

4. Lasers and Consumables: One Expands the Ceiling, One Stabilizes the Floor

Creality’s “beyond printers” story is not just one thing. It has two very different parts:

- Laser engravers expand what users can do. They raise the ceiling.

- Consumables drive repeat buying. They stabilize the floor.

From my view, you need both. But they behave very differently.

Laser Engravers: Bigger Market, Tougher Competition

Laser engraving opens a wider set of use cases. It reaches beyond classic 3D printing users. It also pushes Creality into a more competitive field.

Here is the laser engraver revenue disclosed in the IPO data.

Laser Engraver Revenue (RMB million)

| Period | Revenue |

|---|---|

| FY2022 | 12.6 |

| FY2023 | 111.2 |

| FY2024 | 163.4 |

| 2024 Q1 | 39.7 |

| 2025 Q1 | 44.6 |

This is real growth. But I read it a bit differently than scanners. Scanners show leadership and concentration.

Lasers show market expansion.

That is valuable. It is just less defensible.

Consumables: The Quiet Engine Behind Repeat Revenue

Consumables look small at first. But they change the business model. A printer is often a one-time purchase.

Filament is not.

Here is the consumables revenue from the IPO breakdown.

Consumables Revenue (RMB million)

| Period | Revenue | % of Total Revenue |

|---|---|---|

| FY2022 | 40.4 | 3.0% |

| FY2023 | 136.2 | 7.2% |

| FY2024 | 261.5 | 11.4% |

| 2025 Q1 | 84.7 | 12.0% |

This is a fast rise in share. From my perspective, that is the point. The best hardware businesses do not just sell devices. They also sell what users keep buying.

Consumables Volume and ASP

The IPO document also gives unit volume and pricing.

Consumables Volume and ASP

| Period | Volume (’000 units) | ASP (RMB) |

|---|---|---|

| FY2022 | 665.9 | 60.6 |

| FY2023 | 1,800.0 | 77.7 |

Two things stand out. Volume jumped hard. ASP also rose. This usually means:

- a bigger installed base

- stronger channel reach

- better product mix

It also supports higher lifetime value.

My Take: Lasers Add Reach, Consumables Add Quality

Lasers help Creality reach new users. They expand scenarios.

Consumables do something else.

They make revenue more predictable. They make the business feel more “system-like.”

That matters more after an IPO.

5. Direct-to-Consumer (DTC): This Is Where the Business Really Changes

Many people think DTC is about higher margin. That is only half true.

From my view, DTC is really about control.

Control over pricing.

Control over users.

Control over what happens after the first sale.

This is one of the most important parts of Creality’s IPO story.

The Shift to Online Sales Is Clear in the Data

Here is the exact channel split disclosed in the IPO application.

Revenue figures are shown in RMB million (converted from RMB ’000).

Revenue by Sales Channel

| Period | Online (DTC) Revenue | % | Offline Revenue | % | Total |

|---|---|---|---|---|---|

| FY2022 | 181.5 | 13.5% | 1,164.9 | 86.5% | 1,346.4 |

| FY2023 | 671.5 | 35.7% | 1,211.4 | 64.3% | 1,882.9 |

| FY2024 | 936.6 | 40.9% | 1,351.8 | 59.1% | 2,288.3 |

| 2024 Q1 | 194.6 | 35.4% | 355.7 | 64.6% | 550.2 |

| 2025 Q1 | 339.3 | 47.9% | 368.7 | 52.1% | 708.0 |

In just over two years, online revenue went from 13.5% to nearly half. That does not happen by accident.

Why DTC Matters More Than It Looks

From my perspective, DTC changes three things at once.

First, pricing power improves. The company is not fighting for shelf space.

Second, user data becomes visible. Creality sees what users buy next.

Third, cross-selling becomes possible. Printers lead to filament. Filament leads to upgrades. Scanners and lasers follow.

This is how a hardware company starts to look like a system business.

DTC Also Explains Rising Sales Costs

Some readers worry about higher marketing spend.

I get that concern.

But DTC always looks expensive at first.

You pay upfront to:

- acquire users

- build traffic

- support service and logistics

The payoff comes later.

From what I see in the data:

- customer concentration is falling

- repeat revenue is rising

- margins are improving

That tells me the spend is structural, not wasteful.

My Take on DTC

I do not see DTC as a channel experiment but infrastructure.

Without DTC:

- consumables stay small

- scanners stay isolated

- ecosystem value stays theoretical

With DTC, everything connects. That is why this part matters so much after an IPO.

6. After the IPO: What Changes for the Industry and for Users

An IPO does not just change a company. But it will change how the whole market behaves.

For the Industry: Competition Moves Up a Level

Before, competition was simple.

Faster printer. Lower price. More features.

After the IPO, the game shifts.

The real competition becomes:

- ecosystem vs ecosystem

- structure vs structure

Small players will find this hard. They can copy a printer. They cannot easily copy:

- scanners

- consumables

- DTC systems

- user data

This usually leads to consolidation.

For Competitors: Strategy Becomes a Forced Choice

From my view, other brands now face a clear fork.

Option one: Go deep on one product. Be the best at one thing.

Option two: Build a broader system. Accept higher complexity.

Sitting in the middle is the risky choice.

For Users: Short-Term Gains, Long-Term Lock-In

In the short term, users win.

More products. More promotions. Faster releases.

In the long term, something else happens.

Users stop buying single machines. They start buying into systems. That brings convenience.

It also brings lock-in.

Neither is good or bad by default. It is just the direction of the market.

Final Thoughts

I do not see Creality’s IPO as a story about selling more printers.

I see it as a test.

A test of whether a hardware company can:

- expand beyond one product

- improve revenue quality

- own the user relationship

The data shows the direction is real. Execution will decide the outcome.

But one thing is clear to me: Creality is no longer positioning itself as just a 3D printer brand. It wants to be part of the full creation process. And that is the real meaning behind this IPO.

7. What This IPO Really Represents

At the end of the day, this IPO is not about timing the market. It is about redefining what kind of company Creality wants to be.

From what I see in the data:

- printers bring users in

- scanners raise the entry point

- consumables extend lifetime value

- lasers expand use cases

- DTC ties everything together

None of these alone would change the story. Together, they do.

This does not guarantee success.

Execution risk is real. Competition is still intense. But the direction is clear.

Creality is no longer trying to win by selling more machines. It is trying to win by owning more of the creation process.

That is what makes this IPO worth studying — even if you are not an investor.

disclaimer

This article is based on publicly available information, including the company’s IPO application documents and industry research.

All views expressed are the author’s independent analysis and opinions and do not represent the views of any company mentioned.

This content is provided for informational and educational purposes only and does not constitute investment, legal, or financial advice.

Leave a Reply