xTool has filed its listing application with the Hong Kong Stock Exchange, according to documents published on HKEX News.

Market observers cited by Reuters say the company’s DTC-heavy model sets it apart from traditional hardware brands, positioning it closer to a consumer-tech play than a manufacturing story.

Industry size and market share estimates referenced in the prospectus are based on third-party research from firms such as Frost & Sullivan.

While the filing highlights strong revenue growth and DTC momentum, it also flags material risks — including trade policy exposure, inventory-driven cash flow swings, and product liability inherent to laser-based hardware.

xTool Filed for a Hong Kong IPO

xTool just made its biggest move yet: it’s entered the Hong Kong IPO pipeline. That matters because this isn’t only about one brand, it’s a potential public benchmark for the consumer laser engraving + creator-tools category.

What follows is the clean version: what happened, what the numbers say, what’s actually strong, and what can break the narrative.

IPO Timeline & Key Events

| Date | Event | Why It Matters |

|---|---|---|

| 2025 | Pre-IPO (Series D) financing (~US$200M, Tencent-led) | Signals IPO readiness; strengthens balance sheet |

| Jan 1, 2026 | HKEX listing application made public | Formal start of IPO review process |

| Jan 1, 2026 | Morgan Stanley Asia & Huatai Intl. named coordinators | Top-tier sponsors improve execution credibility |

| TBA | Hearing / pricing / listing date | Will define valuation and market sentiment |

Revenue & Profit Snapshot (RMB, millions)

Note: Figures shown in RMB millions (per HKEX Application Proof)

| Period | Revenue | YoY Growth | Net Profit | Adjusted Net Profit |

|---|---|---|---|---|

| 2023 | 1,456.6 | — | 110.9 | 183.1 |

| 2024 | 2,475.9 | +70.0% | 148.5 | 258.5 |

| 9M 2025 | 1,776.7 | +18.6%* | 83.1 | 172.3 |

Key Numbers

- HKEX filing announcement date: Jan 1, 2026

- Overall coordinators named: Morgan Stanley Asia + Huatai Financial Holdings (HK)

- Revenue: RMB 1,456.6M (2023) → RMB 2,475.9M (2024)

- Gross margin: 59.2% (2023) → 54.4% (2024) → 56.0% (9M 2025)

- Adjusted net profit (non-IFRS): RMB 183.1M (2023), RMB 258.5M (2024)

- DTC share (official website): 62.1% of 2024 revenue

- Geography (2024): U.S. 57.4%, Europe 28.2% of revenue

- Connected machines deployed: 405,000+ (as of Sep 30, 2025)

The News: What happened

On Jan 1, 2026, xTool Innovate Limited published the HKEX-required announcement confirming it had appointed Morgan Stanley Asia and Huatai Financial Holdings (Hong Kong) as overall coordinators for its listing process.

Separate reporting also links this filing to a ~US$200M Tencent-led pre-IPO round in 2025, which often signals a company believes it has the scale and reporting readiness to face public investors.

What xTool says it is

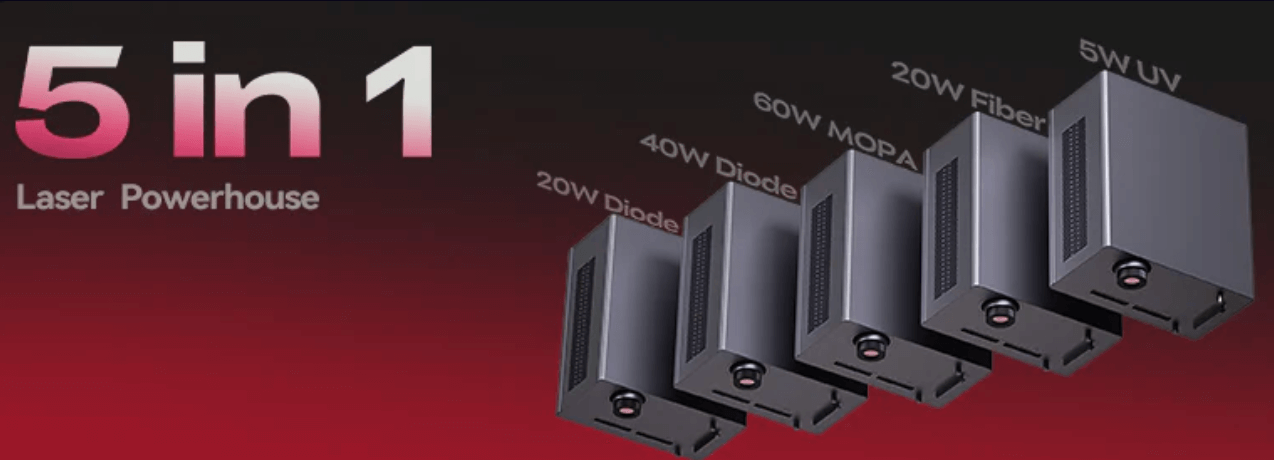

xTool positions itself as a premium consumer-tech brand for digital-to-physical creation, selling laser-based personal creative tools, expanding into material printers, and building repeat revenue through accessories and consumables—supported by its software platform xTool Studio and an AI creative agent (“AIMake”).

The Numbers: Growth is real, margins tell the debate

Revenue growth

The prospectus summary shows revenue rising from RMB 1,456.6M (2023) to RMB 2,475.9M (2024), with 9M 2025 revenue of RMB 1,776.7M.

Revenue & Profit Snapshot (RMB, millions)

Note: Figures shown in RMB millions (per HKEX Application Proof).

| Period | Gross Margin | Adjusted Net Margin |

|---|---|---|

| 2023 | 59.2% | 12.6% |

| 2024 | 54.4% | 10.4% |

| 9M 2025 | 56.0% | 9.7% |

Margins: down in 2024, stabilized in 2025 YTD

- Gross margin: 59.2% (2023) → 54.4% (2024) → 56.0% (9M 2025)

- Adjusted net profit margin (non-IFRS): 12.6% (2023) → 10.4% (2024) → 9.7% (9M 2025)

My read: the market will judge xTool less on “growth exists” (it does) and more on whether it can protect margin as competition intensifies.

The Moat Argument: DTC dominance + cost efficiency signals

| Channel | 2023 | 2024 | 9M 2025 |

|---|---|---|---|

| Official Website (DTC) | 53.1% | 62.1% | 61.1% |

| Other Channels | 46.9% | 37.9% | 38.9% |

This is the line that jumps out: official website revenue = 62.1% of 2024 revenue (and 61.1% in 9M 2025).

Even better: selling & marketing spend is large, but it declined as a % of revenue:

- Selling & marketing: 27.1% (2023) → 22.7% (2024) → 22.6% (9M 2025)

Meanwhile, R&D intensity rose:

- R&D: 10.8% (2023) → 14.5% (2024) → 17.4% (9M 2025)

Translation: they’re telling investors, “We can scale DTC efficiently, and we’re reinvesting to stay ahead.”

The Concentration Risk: This is a US/EU business

| Region | 2024 | 9M 2025 |

|---|---|---|

| United States | 57.4% | 54.8% |

| Europe | 28.2% | 30.3% |

| Other Markets | 14.4% | 14.9% |

Revenue is heavily concentrated in two regions:

- 2024: U.S. 57.4%, Europe 28.2%

- 9M 2025: U.S. 54.8%, Europe 30.3%

That’s great for purchasing power and premium pricing. It also makes the company more exposed to Western consumer cycles, regulation, logistics, and politics.

| Metric | 2023 | 2024 | 9M 2025 | Signal |

|---|---|---|---|---|

| Selling & Marketing (% of revenue) | 27.1% | 22.7% | 22.6% | Scaling efficiency |

| R&D (% of revenue) | 10.8% | 14.5% | 17.4% | Competitive defense |

| Operating Cash Flow | Positive | Positive | -208.8 | Inventory-driven swing |

The 3 Pressure Points that can flip the story

| Bull Case | Bear Case |

|---|---|

| DTC >60% of revenue | Heavy US/EU concentration |

| Strong YoY revenue growth | Seasonal demand volatility |

| Ecosystem: software + materials | Inventory & cash-flow pressure |

| Rising R&D investment | Product liability & safety risk |

1) Trade policy / tariffs are explicitly called out

The risk factors include detailed discussion of changing international trade policies and U.S.-related tariff actions, noting these shifts can affect cost structure and demand.

2) Inventory can distort cash flow (and they admit it)

They disclose negative net operating cash flow of RMB 208.8M in 9M 2025, primarily attributed to strategic inventory stocking ahead of peak season (Q4 2025).

3) Product liability and safety incidents are existential in lasers

The filing states product defects or insufficient risk disclosure can create unsafe conditions, trigger claims, and even recalls—hurting finances and reputation.

What to watch next (5 signals that actually matter)

| Item | Why It Matters |

|---|---|

| IPO pricing range | Defines valuation narrative |

| 2025 full-year results | Q4 decides the year |

| Gross margin trend | Competition pressure signal |

| DTC share changes | Brand power vs platform dependence |

| Inventory & cash flow | Hardware execution discipline |

- Updated timetable + hearing progress (HKEX pipeline momentum)

- Valuation/pricing range (is it “premium consumer-tech” or “hardware cycle”?)

- 2025 full-year results (especially Q4 seasonality impact)

- Gross margin trend (stability vs competition-driven compression)

- Cash flow discipline (inventory swings, working capital, returns/warranty)

Bottom line

xTool’s filing is a real test of whether a premium, DTC-led creator hardware brand can scale globally without sacrificing margin and cash discipline.

Disclosure

This post is for information only and is not investment advice. All figures and claims referenced above come from HKEX-published filing documents and reputable reporting.

Leave a Reply